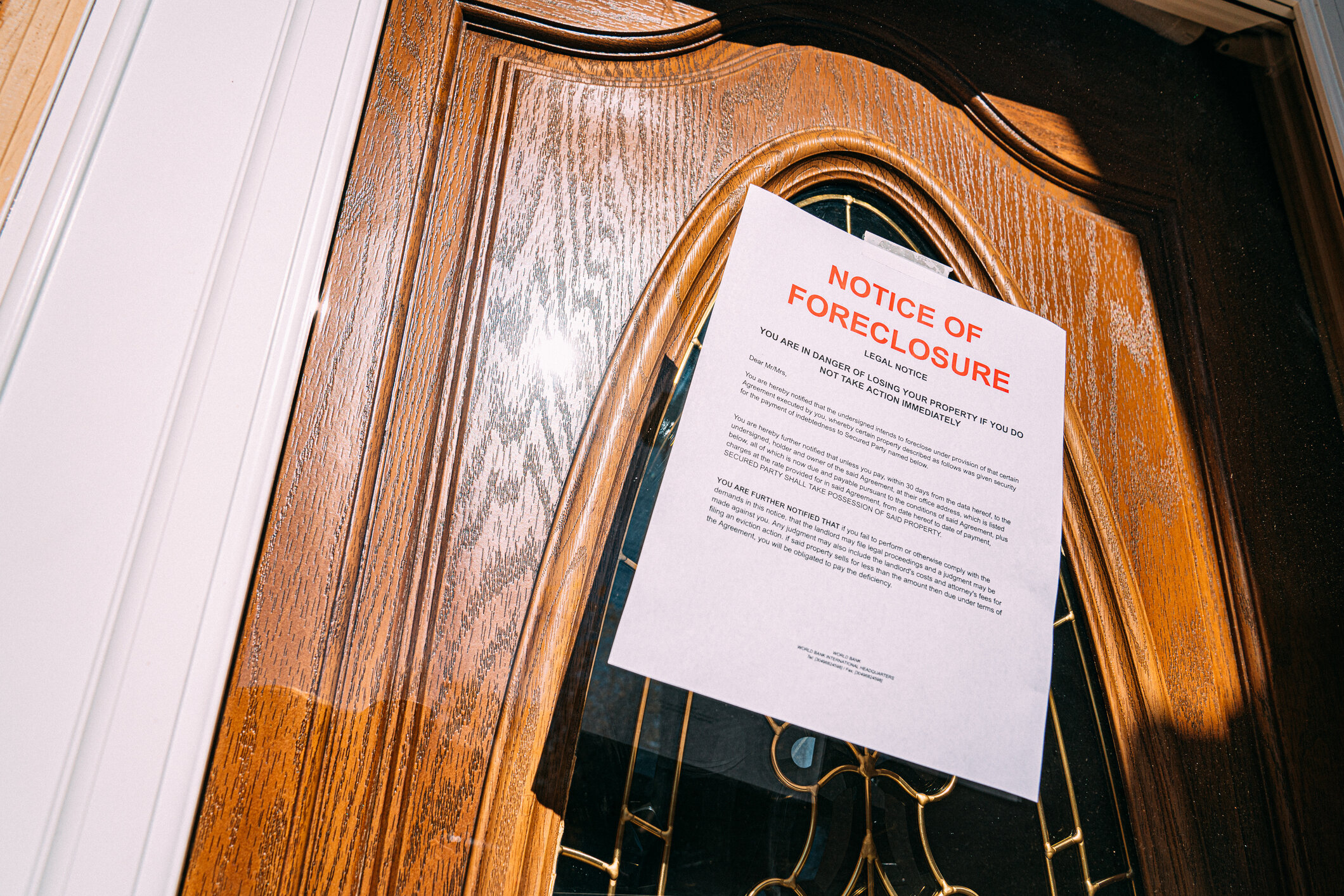

Falling behind on mortgage payments can be overwhelming. The fear of falling behind on mortgage payments can be overwhelming. The fear of foreclosure, credit damage, and losing the place you call home is real—but you’re not alone. Every year, thousands of homeowners in Fort Worth face financial hardships due to job loss, rising living costs, medical bills, or life changes. The good news? There are steps you can take to protect your home and your future.

At Texas Best Home Buyers, we help local homeowners find calm in the chaos. Whether you’re one payment behind or facing a pending foreclosure, here’s what you need to know.

Step One: Contact Your Lender Immediately

It’s natural to want to avoid the problem, but silence can make the situation worse. Your lender may be more willing to help than you think. Early communication could open the door to options like loan modification, repayment plans, or forbearance.

According to the Consumer Financial Protection Bureau (CFPB), “Servicers must help borrowers experiencing financial hardship explore options to avoid foreclosure.” The sooner you reach out, the more options will be available.

Understand Forbearance and Repayment Plans

If your financial difficulties are temporary, a forbearance plan may be suitable. This allows you to pause or reduce your mortgage payments for a limited time. Once the forbearance ends, your lender may require a lump sum, set up a repayment plan, or adjust your loan terms to help you catch up.

While forbearance can provide breathing room, it’s not a long-term fix. Ask detailed questions and understand what happens once the forbearance period ends.

When Selling Your Home May Be the Best Option

For some homeowners, especially those facing prolonged financial instability, selling the home before foreclosure becomes a practical, stress-relieving decision. Selling can protect your credit score, allow you to recover any equity, and help you start fresh without the stigma of foreclosure.

The U.S. Department of Housing and Urban Development (HUD) recommends homeowners consider a pre-foreclosure sale if they’re unable to recover financially, stating: “Selling the home may be preferable to foreclosure to reduce the negative impact on your credit and avoid legal consequences.”

How Texas Best Home Buyers Can Help

We understand how tough this situation can be at Texas Best Home Buyers. That’s why we offer a simple, compassionate process to buy your home fast, as-is, with no fees, no agents, and no waiting. You won’t need to clean, repair, or list your home—we’ll handle everything.

Our team is local to Fort Worth and knows how to work with homeowners in difficult circumstances. We’re not just investors—we’re your neighbors and want to help you move forward with peace of mind.

Benefits of Selling Before Foreclosure

- Avoid long-term credit damage.

- Stay in control of the process.

- Eliminate legal and financial stress.

- Walk away with dignity—and possibly some equity.

Explore More Resources

If you’re behind on mortgage payments, don’t wait until foreclosure feels inevitable. Explore your options, talk to professionals, and consider a solution that gives you the freedom to start fresh.

To learn more about your options as a Fort Worth homeowner, visit our blog page for practical advice, success stories, and more helpful guides.